For the past year, supply-related problems contributed more to inflation than demand-related imbalances, but that may be changing soon. There are at least three factors that could change the course of inflation. First, the improvement in shipping and general supply bottlenecks could ease inflation. Second, strength in the U.S. dollar could offset some of the current inflationary pressures. And third, import prices have moderated since the beginning of 2022 and as import prices slow, we expect consumer prices to eventually reflect the slowdown in import prices.

What was keeping inflation elevated?

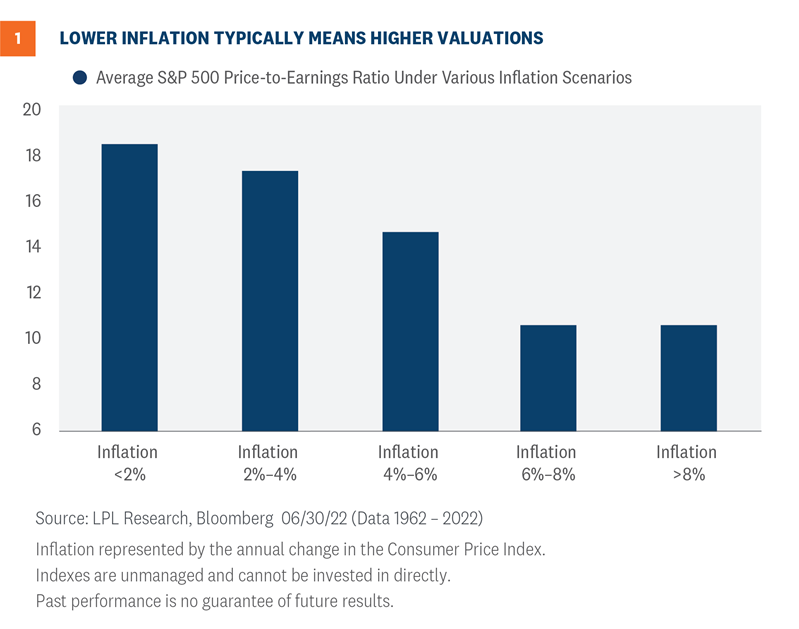

In recent months, inflation was lifted by supply bottlenecks, stimulus money, and loose monetary policy. As we navigate the uncharted waters of historically high global inflation, we can best understand the underlying trends by taking an individual look at the various components. Current inflationary reports are highly nuanced right now. Durable goods prices are clearly past peak but in contrast, services inflation is not slowing down [Figure 1]. As consumers pivot to more services spending, travel-related consumer prices will likely take a longer time to moderate relative to goods prices.

With all the talk on durable goods inflation rates decelerating but services accelerating, in actuality inflation may not reach the preferred 2% target in the near term. Consumers may have to live in a new world where inflation consistently runs hotter than the previous decade. At least, that’s what global central bankers warned at a European Central Bank (ECB) summer conference in Portugal. Reshoring production, newer health protocols, and tight labor markets could keep inflation rates above the 2% long run average for the near term.

Policy makers must come to grips with a real possibility that inflation rates will not come down to their preferred targets any time soon. The latest inflation report is a juggernaut for the Federal Reserve (Fed) as they use blunt instruments to slow aggregate demand during a time when inflation is also irritated by supply shocks. But good news may be looming ahead. Inflation may eventually be less impacted by supply bottlenecks.

First Factor: Rotation in Contributors May Be a Bright Spot

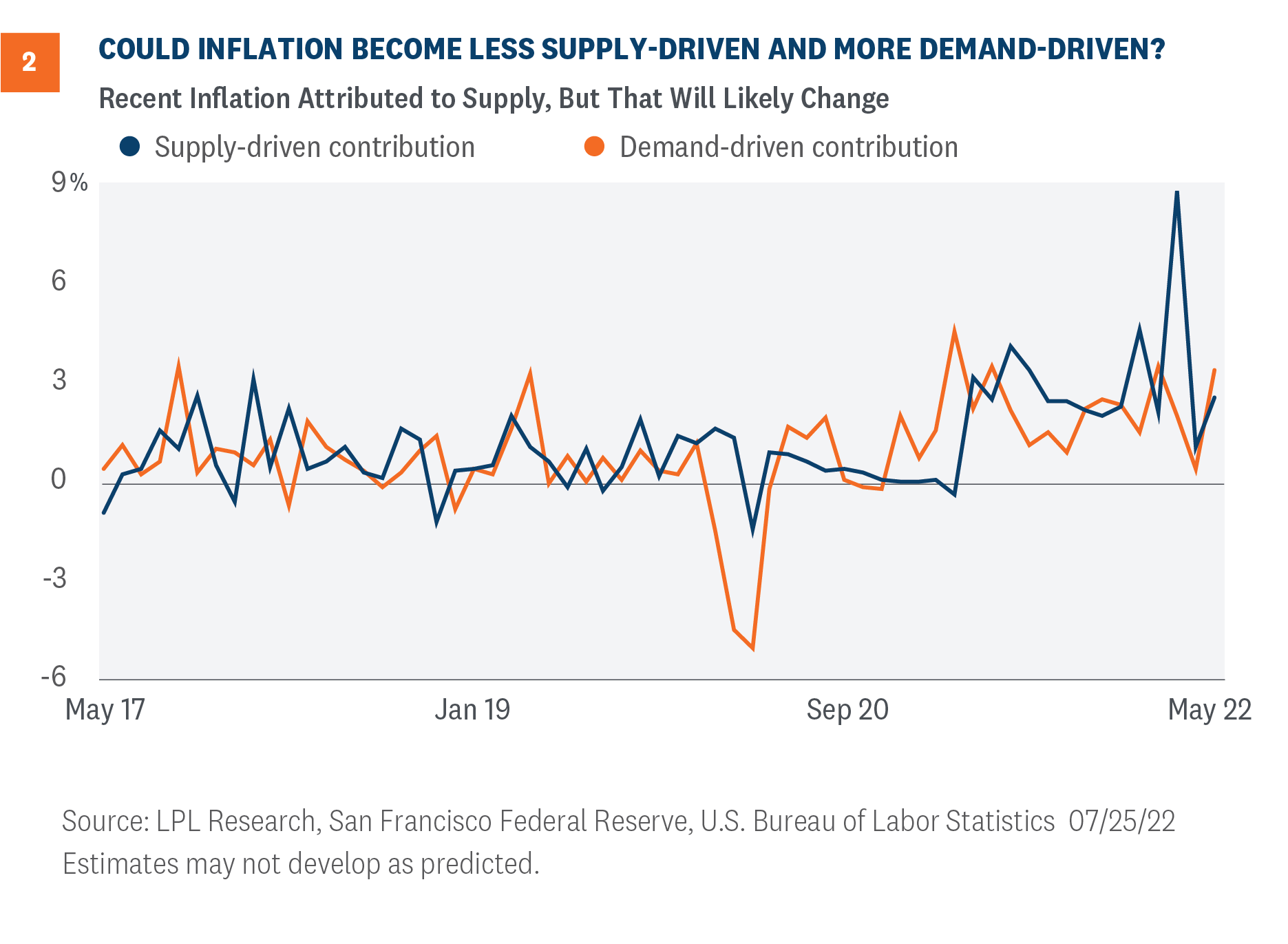

Inflation dynamics may be at a crossroad. Since the onset of the global pandemic, the inflationary environment has been irritated by supply-related problems with ports, international manufacturing shutdowns, and global shipping as primary challenges. And indeed, these have been major factors in supply chains and inventory management. For example, auto manufacturers are still hampered with ready access to necessary components.

Well, the good news is that as of the last inflation report, the supply contribution to inflation fell and demand-driven contributions to inflation became more of a dominant factor. So, this fits perfectly into the script for the Fed. We know their monetary policy tools, albeit blunt, are suited for tamping down aggregate demand, and as Chair Powell himself warned, “Our tools don’t work on supply shocks.”

Fed policy works on a lag, meaning that a Fed decision takes some time to filter through the system, but we think that Fed monetary policy may actually be an important factor for addressing the current inflationary problems in the U.S. as inflation rotates to a demand-induced problem and less of a supply-induced problem [Figure 2].

Second Factor: Strong Dollar Affecting Purchasing Power

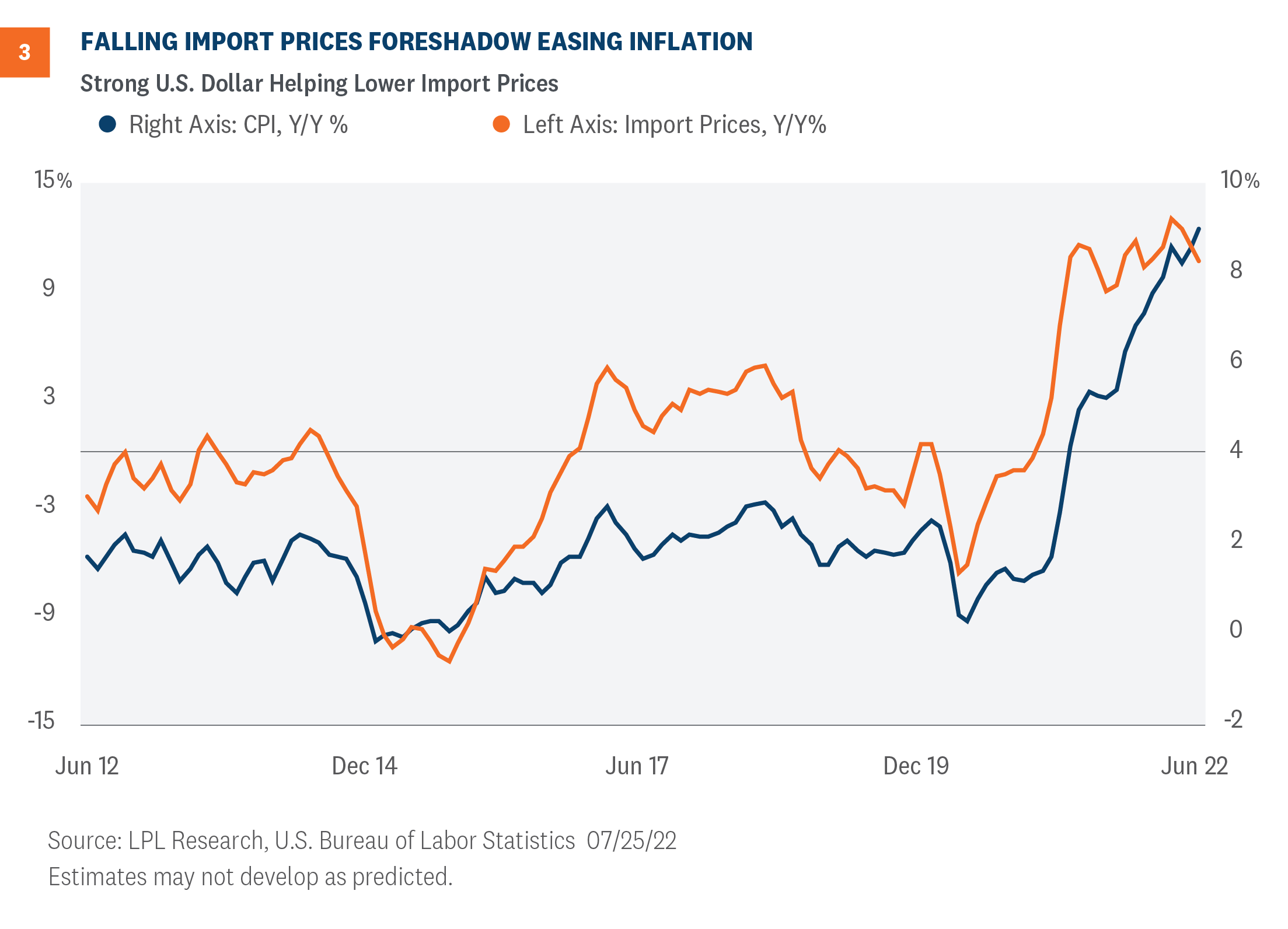

A strong U.S. dollar could help ease some of the pressure off of the high prices we have right now. Of course, we know that a sustained strong dollar will eventually give us some greater purchasing power in the global markets and will pull down import prices. The year 2022 started out with import prices rising very quickly on a monthly basis. In just the 31 days of January, import prices rose 2% and then import prices rose another 2% month over month in February and roughly 3% in March. These import prices were running hotter than the CPI over that same time period. As the dollar has rallied in recent months, import prices have also cooled. For example, June import prices rose a mere 0.2%, the smallest increase in six months.

Third Factor: Lower Import Prices are Net Positive for Taming Inflation

It will take some time to filter through to the end consumer, but the recent trends in the U.S. dollar could keep import prices at bay and by transmission, tamp down some of the import-sensitive consumer prices. So a slowdown in import prices, partially attributed to a strong U.S. dollar, is an important variable we think could ease these pesky levels of consumer inflation [Figure 3].

Conclusion: What Does This Tell Us About Fed Policy?

Our base case for the federal funds target rate at the end of this year is 3.50% with potential for the terminal rate to eventually reach 3.75%. However, the nagging persistence of some consumer prices or the rising risk of a contracting economy might change the plans for the Fed. The Fed is widely expected to raise rates by 75 basis points in July and then downshift rate hikes to increments of 50 and 25 basis points. Investors and policymakers know inflation will likely stay above target for a while but both will focus on the direction of the change.

Click here to download a PDF of this report.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

All index data from FactSet.

Personal consumption expenditures (PCE) is a measure of price changes in consumer goods and services released monthly by the Bureau of Economic Analysis (BEA). Personal consumption expenditures consist of the actual and imputed expenditures of households; the measure includes data pertaining to durables, nondurables, and services. It is essentially a measure of goods and services targeted toward individuals and consumed by individuals.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered inv estment advisor and broker -dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment a dvice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

| Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value |

RES-1222436-0722 | For Public Use | Tracking # 1-05308314 (Exp. 07/23)