2025 was a good year for most fixed income markets but we’re approaching 2026 with caution. All-in yields are still attractive for most markets, but spreads (the additional compensation for owning riskier debt) are low, suggesting investors aren’t getting paid to take on a lot of credit risk right now. Federal Reserve (Fed) policy will be key, though, in determining returns in 2026, but with a new Chair expected at the helm by May, rate volatility could remain elevated. Each year, fixed income investors should reasonably expect coupon-type returns, plus or minus price appreciation based upon changing interest rates. But, with our expectations of a rangebound rate environment next year, returns will likely be primarily income-driven. Here we feature LPL Research’s fixed income market outlook for 2026, taken from our Outlook 2026: The Policy Engine.

LPL Research 2026 Fixed Income Market Outlook

Our 2026 fixed income outlook calls for a rangebound rate environment, cautious Fed policy, and a modest increase in spreads within corporate credit markets. Markets expect the Fed to lower the fed funds rate to around 3%, likely keeping the 10-year Treasury yield between 3.75% and 4.25%. Inflation remains above target, limiting aggressive cuts, so returns may be income-driven. Corporate credit spreads remain historically tight despite rising idiosyncratic risks, including defaults and refinancing challenges, which should pressure spreads higher, particularly if Treasury yields fall towards the low end of our expected range. We believe investors should maintain neutral duration, favor high-quality bonds over cash as yields decline, and approach high yield and leveraged loans cautiously. Agency mortgage-backed securities (MBS) and investment-grade corporates should outperform Treasuries, while riskier sectors face constrained upside, in our view.

Fed Policy, r-Star, and the Outlook for Long-Term Rates

If the Fed maintains a “slightly restrictive” stance, as it has suggested, the 10-year yield may remain elevated relative to historical neutral levels. However, any shift in the Fed’s tone — whether toward easing or a more neutral posture — could prompt a recalibration in market pricing, particularly if inflation continues to moderate and growth slows. Ultimately, our rate outlook reflects a balance between what the Fed is likely to do and what markets have already priced in, with the neutral rate serving as a key reference point in that assessment.

The neutral rate of interest, often referred to as r-star (r*), represents the theoretical interest rate at which monetary policy neither stimulates nor restricts economic growth when the economy operates at full employment with stable inflation. This equilibrium concept, while unobservable, plays a crucial role in guiding Fed policy decisions and profoundly influences Treasury market dynamics.

Estimates of r-star have declined significantly over recent decades, falling from around 4–5% in the pre-global financial crisis era to current estimates ranging between 2.5–3.5% in nominal terms, though considerable uncertainty surrounds these figures. According to the recently released December dot plot, there are 11 different views within the 19 member Federal Market Open Committee (FOMC) ranging from 2.6% to 3.9%. With inflationary pressures falling from peak levels but still meaningfully above the central bank’s 2% objective, the Fed has signaled its intention to gradually reduce rates toward a “slightly restrictive” stance rather than immediately returning to neutral.

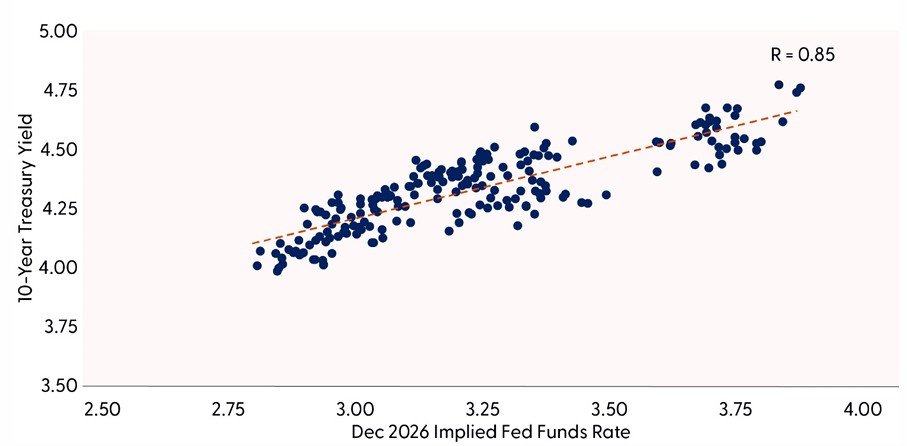

Given the uncertainty about what the neutral rate is, though, there are several differing views within the committee, ranging from zero to four expected cuts in 2026. Importantly, market pricing suggests that the Fed’s rate-cutting campaign could end by the second half of 2026 with a trough rate of around 3%. If market pricing is right (and given the historical 1.0% average non-recessionary spread between the 10-year and the fed funds rate, as we noted in last year’s 2025 Outlook), it’s likely the 10-year Treasury yield will remain around 4.0%. To get a lower 10-year Treasury yield, market pricing would need to show an accommodative monetary policy stance with the fed funds rate meaningfully below 3%. And while we expect the economy to slow into the first part of 2026 before rebounding later in the year, with inflationary pressures still above the 2% target, it’s unlikely the Fed will cut rates to levels that would take the 10-year Treasury much lower. Thus, we think a 3.75–4.25% 10-year Treasury yield range for 2026 is appropriate, at least for now. Additionally, with upcoming changes to the FOMC — expected to adopt a more dovish stance following Chairman Powell’s departure in May and the Trump Administration’s appointment of his successor — market expectations will likely shift toward deeper rate cuts than currently priced in. This dynamic should help prevent the 10-year yield from drifting meaningfully higher (absent a reacceleration of inflationary pressures, which isn’t our base case). As such, we don’t think right now is a good time to overweight or underweight duration (interest rate sensitivity) in fixed income portfolios. A neutral duration relative to benchmarks is, in our view, still appropriate. And for those investors who want to own bonds for income, the belly of the curve (out to 5-years) remains attractive.

10-Year Treasury Is Highly Correlated to the Expected Fed Funds Trough Rate

Source: LPL Research, Bloomberg 10/30/25

Disclosures: Past performance is no guarantee of future results. Any companies or options referenced are being presented as a proxy, not as a recommendation.

Fed Balance Sheet in Focus in 2026

While rate cuts will dominate fixed income discussions in 2026, the Fed’s balance sheet strategy is also worth watching. Following its December meeting, the Fed launched temporary reserve management purchases (RMPs), buying roughly $40 billion in T-bills to maintain “ample” reserves and avoid short-term funding stress. This move is not quantitative easing (QE) per se — unlike QE, which targets longer-maturity Treasuries and MBS to lower long term rates and stimulate growth — RMPs focus on short-term T-bills and have minimal impact on the yield curve.

Purchases are expected to taper after a few months, though history suggests such programs often linger longer than planned. Nonetheless, while not technically QE, Fed liquidity reduces the chances of short-term funding market flare-ups, which have increased as of late. Moreover, the Fed is once again reinforcing the narrative that they will provide a countercyclical response to market stresses, which is ultimately good for financial markets, including the fixed income markets.

The October meeting minutes added another layer of interest, though — the Fed intends to gradually align its System Open Market Account (SOMA) portfolio with the Treasury’s issuance mix. Currently, SOMA is overweight long-duration bonds, with 10+ year maturities making up 38% of holdings versus 18% in the broader market. Going forward, the Fed plans to allocate more toward shorter maturities, reflecting Treasury’s preference for issuing debt in the two- to seven-year range. If implemented, this shift could reduce support for longer-term Treasuries, adding to volatility in the 10-year and beyond — especially as global demand for duration remains weak.

In short, while the balance sheet is no longer shrinking, its evolving composition could influence market dynamics. A shorter-duration SOMA portfolio combined with temporary liquidity operations underscores the Fed’s balancing act: easing policy without reigniting inflation, while ensuring funding markets remain stable. For investors, this means the long end of the curve may stay volatile even as short-term rates decline.

Credit View: Cockroaches, Canaries, and Zombies?

In corporate credit markets, early indicators of stress often emerge subtly — not through dramatic dislocations, but through subtle shifts in borrower behavior, isolated defaults, and nuanced changes in market dynamics. Much like the canaries once used in coal mines to detect invisible threats, corporate credit markets often serve as early warning signals for broader economic vulnerabilities.

While investment-grade bonds continue to benefit from strong technicals and steady demand, the picture is less reassuring for lower-rated issuers. Recent defaults and a rise in payment-in-kind activity suggest that the leveraged credit space is under pressure. J.P. Morgan CEO Jamie Dimon’s recent analogy comparing credit events to cockroaches — where one sighting implies many more — feels particularly apt. The public collapse late in 2025 of companies like Saks, New Fortress Energy, and Tricolor Holdings have inflicted steep losses on investors, raising concerns that these aren’t isolated incidents.

Data from Cornerstone Research underscores the trend: the first half of 2025 saw a record number of “mega” bankruptcies, with large-company filings up 81% over the long-term average. The refinancing wall looming in 2026/2027 poses additional risks, especially for companies that issued debt during the ultra-low-rate era and now face significantly higher rollover costs.

Moreover, the growing tally of “zombie companies” — mostly smaller cap companies with higher interest rate costs than income — adds to the potential for additional idiosyncratic risks within corporate credit markets. With limited relief in sight from tariffs or interest rates, these firms may face restructuring or default unless they can repair their balance sheets.

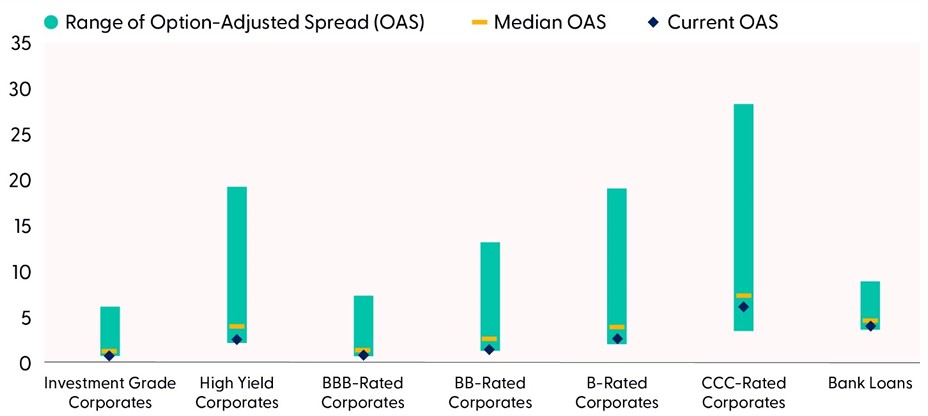

Despite these challenges, the broader credit market is not in crisis, nor do we think we are on the cusp of systemic credit issues. Our issue is with market valuations. Credit spreads, or the additional compensation for owning risky debt, remain historically tight given these rising idiosyncratic risks. Both high-grade and high-yield companies currently enjoy spreads at or near the lowest levels over the past 20 years. Only CCC-rated companies, which are the ones most prone to default, have spreads above recent secular tights. But even these spreads are only in the 29th percentile versus history, meaning spreads for these companies have been higher 71% of the time over the past 20 years. Given the increased risks but still solid economic growth, though, we expect spreads to widen somewhat from current levels but to remain below long-term averages.

Spreads for Most Credit Markets Remain Below Long-Term Averages

Source: LPL Research, Bloomberg 12/17/25

Disclosures: Past performance is no guarantee of future results.

Our main point here is that corporate credit investors should remain vigilant. While yields may appear attractive, spreads remain below longer-term averages and are arguably not providing sufficient compensation to take on these emerging credit risks. Active portfolio management and strategies that are unwedded to corporate bond indexes may be able to help navigate these issues.

To be fair, spreads can stay tight for long periods of time, with the 1990s a prime example of expensive credit markets that lasted for years between spread-widening events. Nonetheless, investors should remain cautious, balancing the appeal of attractive yields with a clear-eyed understanding of the underlying risks. As always, diversification, discipline, and a long-term perspective will be key to weathering any turbulence that may lie ahead. Corporate credit markets are still generally well-priced, in our opinion, so we don’t think investors are being appropriately compensated given current (and growing) risks. Securitized markets — residential MBS, asset-backed securities, and select commercial mortgage-backed securities — remain attractive, in our view.

What to Expect in 2026

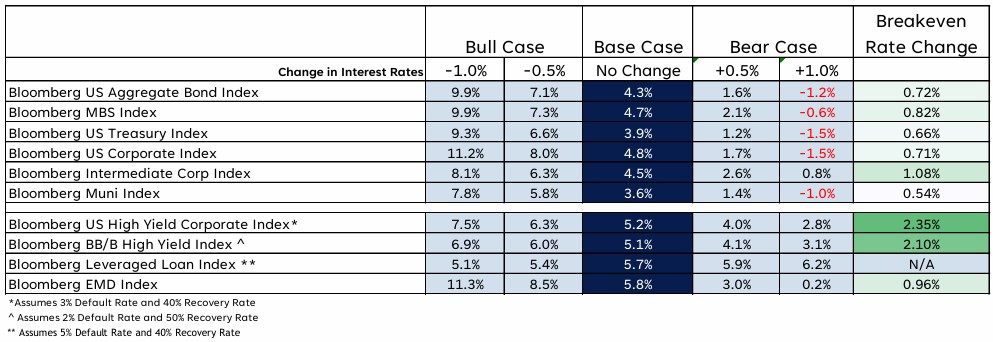

With Treasury yields largely expected to stay rangebound, with the 10-year Treasury yield between 3.75% and 4.25% in 2026 and with credit spreads unlikely to tighten much from current levels, returns will likely be primarily driven by income. Agency MBS and investment-grade corporates should outperform Treasury securities given the higher starting yields for both asset classes, but given our outlook on rising idiosyncratic risks within the corporate credit markets, we still have a (marginal) preference for MBS over corporates. Importantly, as the Fed continues to cut short-term interest rates, cash yields will come down as well, which should allow high-quality fixed income markets to outperform cash holdings once again.

While riskier segments within the fixed income market have higher starting yields, the potential for spread widening and increased default activity leaves hypothetical returns below core bond sectors in most expected environments. A stable or slightly higher interest rate environment and even tighter spreads are needed for high yield and leveraged loan sectors to outperform core sectors. We remain neutral (although biased negative for tactical models) on both asset classes but would lean towards high yield over leveraged loans, if pressed, given the potential for price appreciation if interest rates fall.

Hypothetical Returns: Interest Rate Scenario Analysis

Source: LPL Research, Bloomberg 12/17/25

Disclosures: Past performance is no guarantee of future results. Any companies or options referenced are being presented as a proxy, not as a recommendation.

The Bottom Line

In a rangebound yield environment with limited spread compression, fixed income returns in 2026 will be driven primarily by income. We favor securitized markets generally and agency MBS specifically over investment-grade corporates due to rising idiosyncratic risks, and expect high-quality bonds to outperform cash as Fed rate cuts lower short-term yields. Riskier credit segments may underperform core sectors unless rates fall or spreads tighten meaningfully, with a slight tactical bias toward high yield over loans.

Asset Allocation Insights

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities as 2025 winds down. Investors may be well served by bracing for occasional bouts of volatility given how much optimism is reflected in stock valuations, but fundamentals remain broadly supportive. Technically, the broad market’s long-term uptrend remains intact, leaving the Committee biased to buy dips that emerge between now and year-end.

STAAC’s regional preferences across the U.S., developed international, and emerging markets (EM) are aligned with benchmarks. The Committee still favors the growth style over its value counterpart, large caps over small caps, and the communication services sector. The Committee is closely searching for opportunities in the healthcare and industrials sector and continues to watch for opportunities in the technology sector to potentially add on weakness.

Within fixed income, the STAAC holds a neutral weight in core bonds, with a slight preference for (MBS) over investment-grade corporates. The Committee believes the risk-reward for core bond sectors (U.S. Treasury, agency MBS, investment-grade corporates) is more attractive than plus sectors. The Committee does not believe adding duration (interest rate sensitivity) at current levels is attractive and remains neutral relative to benchmarks.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

High yield/junk bonds (grade BB or below) are not investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet or Bloomberg.

This research material has been prepared by LPL Financial LLC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0006412-1125 Tracking #839664 | #839666 (Exp. 12/26)